Congratulations!

We are glad you made it to this page.

Unfortunately, many CPAs won’t!

“A Wise Person Investigates what a Fool Takes for Granted”

Please check out the information on this page. If you have questions, please contact our team member who appears at the bottom of this website. Better yet, just click on the getting started button, register as an affiliate partner, take the training, get access to your back office and start spreading the good news!

Learn Even More:

Thousands of Millionaires

Joe's Story

Income Potential

Why don’t I just file the ERC for my clients myself?

That is certainly an option if you have the TIME. I personally believe time is the most valuable asset any of us have. Once it is gone you can never get it back. Becoming a Bottom Line Affiliate partner enables you to probably earn more money, but more importantly gives you a unique leverage. The majority of the CPAs on our team love the fact that they can make great commissions just by referring others, and they don’t have to go through the headaches of doing the actual work.

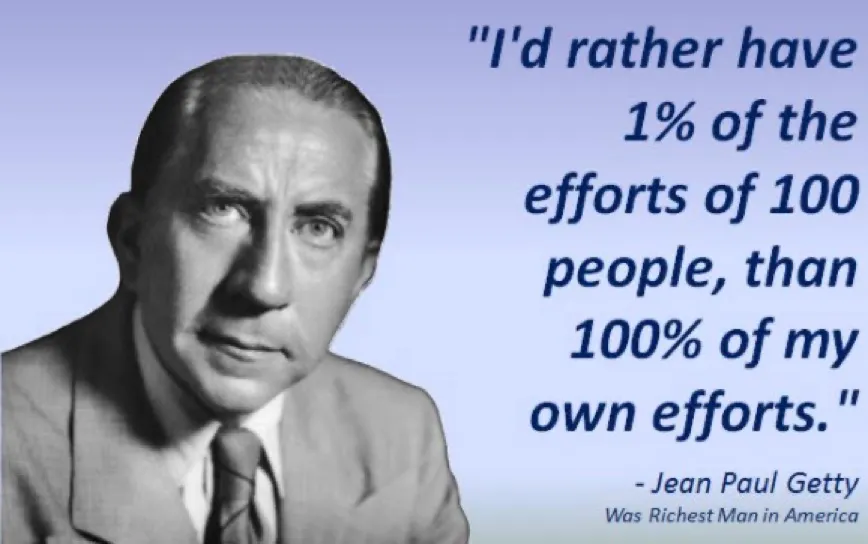

One of my favorite quotes is from J. Paul Getty who was the richest man in the world at the time he said:

By becoming a Bottom Line Referral Partner with our iHub Global team you can earn 17% and you have the staff of 120 Bottom Line Concepts employees doing the work for you. This opportunity is exciting for most of the over-worked CPAs who join our team.

For those of you that may have bitten the bullet and studied the ERC bill, you know the complexity and expertise required to properly file for the Employee Retention Tax Credit is at a high level. Not to mention trying to keep up with the amendments and changes. (There have been seven so far) There is tremendous value you provide to your customers by referring them to Bottom Line Concepts, who specializes in ERC, and has a proven track record of recovering funds for many businesses. I am sure many reading this have filed for PPP for their business clients, but filing their ERC is a completely different, time-consuming project. They are very different types of filing, paperwork, and calculations. PPP is a loan, meanwhile ERC is a grant.

The ERC is a complex 280+ page stimulus plan that has been amended, revised, and changed over time. This requires you to know every facet of how the ERC stimulus program has been updated. Not to mention, the expertise to properly file for ERC and maximize the credits for your clients.

When you consider the fact that the program will end in April of 2025 why should you invest the time to understand how the program works, whether a business is eligible or what qualifies a business, and how to file for ERC? Do you really have time to dissect a two hundred and eighty page document? By the time you are ready to accept clients you could have already put dozens of them into the Bottom Line System and earned hundreds of thousands of dollars in commissions. Let’s get you started!

Questions?

Contact:

Click Here to Become an Affiliate Partner. We Look Forward to Working with You.